Summary of Glaston Corporation‘s Interim Report for January-March 2022. The complete report can be downloaded, as a pdf file, from here. The release is also available on the company’s website.

January─March 2022 in brief

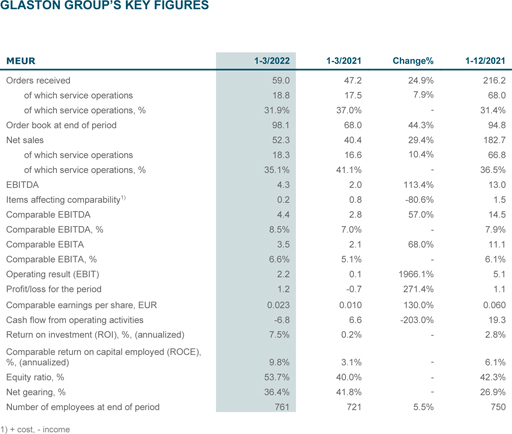

- Orders received totaled EUR 59.0 (47.2) million.

- Net sales totaled EUR 52.3 (40.4) million.

- Comparable EBITA was EUR 3.5 (2.1) million, i.e. 6.6 (5.1)% of net sales.

- The operating result (EBIT) was EUR 2.2 (0.1) million.

- The comparable earnings per share were EUR 0.023 (0.010).

Glaston Corporation’s President & CEO

Anders Dahlblom, President & CEO of Glaston Corporation, said, “In the first quarter of 2022, Glaston’s markets continued to develop positively and orders received were up 25 percent compared to the corresponding period in 2021, totalling EUR 59.0 million. In particular, the demand for insulating glass equipment increased but demand for automotive glass machines also saw good progress.

“From a regional point of view, America’s order intake was the highest of our regions and performance was excellent, particularly for Heat Treatment equipment. First-quarter net sales were up by 29 percent to EUR 52.3 million, primarily due to the good order intake in 2021. Comparable EBITA improved and was EUR 3.5 million, corresponding to an EBITA margin of 6.6 percent. Besides the volume growth, focused operational execution and good pricing management contributed to the outcome.

“In the January−March period, the Services business was on a high level with an increasing number of inquiries as customers started ramping up their production. For upgrades, the good order intake continued with the Americas in the lead. Supply chain disruptions adversely impacted spare parts sales and delivery times.

“Despite the significant underlying growth potential in our regions, signs of increasing market uncertainty and more cautious customer behaviour have been perceptible, partly due to the Russian invasion of Ukraine and its related effects and, in some parts of the world, due to the COVID-19 pandemic. Furthermore, amid rising prices and supply imbalances, we can see decision times for new projects increasing.

“Shortly after the invasion of Ukraine, it was already clear to us that continuing our operations in Russia was not an option. We have taken the necessary actions to close our sales office in Moscow and currently business with Russia is suspended. The financial impact of our exit decision is limited, as Russia accounted for less than one percent of our net sales in 2021. The invasion may further complicate the supply chain disruptions, with a shortage of various raw materials and components also leading to increasing costs. Mitigating the supply chain disturbances continues to be a key focus area.

“In the first quarter, China saw a new outbreak of corona virus. Restrictions and lock-downs were imposed in several cities thereby also affecting operations at Glaston’s factory in Tianjin. Additionally, some machine deliveries had to be postponed due to lock-down-related logistic challenges. Supply chain disruptions further complicated the situation. We are closely monitoring the development in China and its implications on the operating environment. In January−March, China’s share of total net sales amounted to approximately 15 percent. Prolonged restrictions and lock-downs would impact our business in the mid-term.

In 2022, Glaston is celebrating the International Year of Glass (IYOG 2022). To acknowledge the essential role glass has and will continue to have in society, the General Assembly of the United Nations has designated 2022 as the International Year of Glass (IYOG 2022). Glaston, as a member of the International Commission on Glass, the organization behind the IYOG 2022 initiative, will highlight the International Year of Glass throughout 2022.

In the review period, Glaston’s markets developed well. Despite increasing geopolitical turbulence and soaring COVID-19 numbers, the underlying demand for Glaston’s products and services remains good and our high order backlog will support our performance for the coming quarters.”

Glaston’s outlook for 2022 remains unchanged

In 2021, Glaston’s markets saw a strong recovery and growth. This positive development continued in the first quarter of 2022, indicating good development for both machines and services business. Glaston started the year with a 48 percent higher order backlog than in 2021, which supports Glaston’s net sales and profitability development. In 2022, Glaston is focusing on the execution of its strategy, which will incur costs and capital expenditure ahead of the effect on revenue growth.

Currently, higher than normal uncertainty is related to the development of economic activity and customers’ investments. The uncertainty is driven by several simultaneous factors, such as the supply chain disturbances that have become a longer-term challenge, the Russian invasion of Ukraine with its implications on energy and raw material prices, and the still ongoing COVID-19 pandemic.

Despite the prevailing uncertainties, Glaston Corporation expects market development to continue to be positive and estimates that its net sales and comparable EBITA will improve in 2022 from the levels reported for 2021. In 2021, Group net sales totaled EUR 182.7 million and comparable EBITA was EUR 11.1 million.

Press Meeting

Glaston’s CEO Anders Dahlblom and CFO Päivi Lindqvist presented the financial result to analysts, investors and media representatives April 27 at 10:30 (Finnish time) in English.

The audiocast can be accessed through the link: https://glaston.videosync.fi/results-q1-2022/register. An on-demand version of the presentation will be available on the company’s website later during the same day.